Please click here to view the Calculation of Taxable portion of Lump sum pension

Homepage

Featured Articles

Deadlines for submission of requests for reimbursement of taxes

- Staff serving in the U.S. - 1st working day of March

- Staff serving elsewhere - 1st working day of April

Copies of tax returns and related United Nations forms must be received by the Income Tax Unit of the HQCSS/Department of Operational Support by the above dates.

We are happy to announce the launch of our new course: United Nations Tax Procedure for US Taxpayers on the CDOTS campus.

Self-Employment Tax contains Social Security Tax and Medicare Tax. Employee’s portion of Social Security Tax for 2023 was 6.2%. The maximum wages and earnings subject to social security tax is $ 168,600 for 2024 and it increases to $ 176,100 for 2025.

To ease the process of setting up meetings with a member of the Income Tax Unit, we are excited to launch Virtual Tax Meet, a self-service scheduling tool. Virtual Tax Meet will allow you to schedule a virtual 20-minute conversation with a member of our team. When scheduling a meeting for “All Other Topics”, please schedule with the Tax Unit Specialist associated with the first letter of your last name:

- A, E, G N: Rekha

Haven't Received Your Advance Payment of the Child Tax Credit Issued to You Yet?

There’s limited time to have the IRS trace a missing Advance Child Tax Credit payment.

Form 3911 submission to IRS

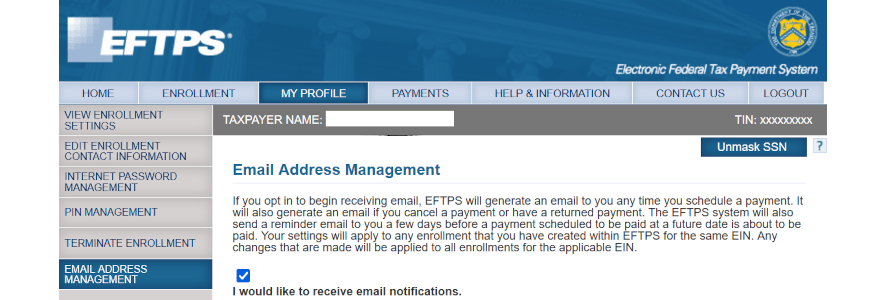

The Electronic Federal Tax Payment System (EFTPS) tax payment service is provided free by the U.S. Department of the Treasury. After you've enrolled and received your credentials, you can pay any tax due to the Internal Revenue Service (IRS) using this system.

The Income Tax Unit can send your U.N. estimated tax advance payments via electronic funds transfer (EFT) to both IRS and NY State if you enroll yourself with the EFTPS.

Important Deadlines of 2025 (For 2024 Income tax Reimbursement)

|

Events |

US Based Staff |

Overseas Staff |

|

Q4 Advance of 2024 |

15 January 2025 |

15 January 2025 |

|

Statement of Taxable Earnings (STE, equivalent to W2 or 1099) Will be distributed to all staff by email. |

31 January 2025 |

31 January 2025 |

|

ST/IC/2025/? (instruction/rules and procedure) will be posted in UN Forms |

31 January 2025 |

31 January 2025 |

|

UN Forms for 2024 (F.65, F.65A and IRS 4506C) will be uploaded in UN Forms and available for use. |

31 January 2025 |

31 January 2025 |

|

Income Tax Briefing (VIRTUAL) |

6 February 2025 (Virtual) At 9:30 AM EST |

6 February 2025 (Virtual) At 9:30 AM EST |

|

UN Tax portal is open to use |

7 February 2025 |

7 February 2025 |

|

2024 Tax Claim submission Deadline (to UN Income Tax Unit) |

3 March 2025 |

1 April 2025 |

|

2024 Tax filing Deadline to IRS |

15 April 2025 |

16 June 2025 |

|

2024 Tax Settlement Payment Deadline to IRS |

15 April 2025 |

15 April 2025 |